🚨78% CHANCE OF A FED RATE CUT IN SEPTEMBER🚨

THIS WEEK’S MARKET MOVING NEWS FOR THE WEEK OF JULY 8TH

July 8, 2024

This week is brimming with significant economic data and events that will be keenly observed by analysts, investors, policymakers, and myself. We're nearing an economic climate that could justify a Federal Reserve rate cut, leading to more favorable conditions for homebuyers.

Here's a detailed look at what to expect:

Key Economic Reports

June’s Inflation Data: Consumer Price Index (CPI) - Thursday

The CPI report measures inflation at the consumer level, showing changes in prices for goods and services. This data will shed light on current inflationary pressures and the cost of living.

Producer Price Index (PPI) - Friday

The PPI tracks wholesale inflation, indicating the average change in prices received by domestic producers. It’s a leading indicator of consumer price inflation and can signal upcoming price hikes for consumers.

Weekly Jobless Claims

With recent increases in jobless claims, this weekly report is vital for assessing the health of the labor market and potential economic slowdowns.

Significant Events

Fed Chair Powell Testifies - Tuesday

Federal Reserve Chair Jerome Powell will testify before Congress, providing critical insights into the Fed’s economic outlook, monetary policy, and future interest rate decisions. Market reactions are highly influenced by his testimony.

OPEC Monthly Report - Wednesday

The Organization of the Petroleum Exporting Countries (OPEC) will release its monthly report, including data on oil production, demand forecasts, and global energy market insights. Fuel prices affect almost everything, making this report crucial.

Michigan Consumer Sentiment Data - Friday

This report measures consumer confidence in economic activity. Higher consumer sentiment can indicate increased consumer spending, driving economic growth. It’s a key gauge of how people feel about spending money.

Additional Highlights

Fed Speakers

There will be nine Fed speaker events this week. Comments from Federal Reserve officials can shape market expectations about monetary policy and economic conditions. I expect to hear more reassuring sentiments towards rate cuts this year, with at least one cut likely, in my opinion.

Why These Events Matter

Inflation Data (CPI and PPI)

Inflation impacts purchasing power, interest rates, and overall economic stability. High inflation can lead to increased borrowing costs and reduced consumer spending. It’s one of the two major data categories the Fed focuses on to justify a rate cut. Once cuts begin, the economy will be stimulated, though it’s a risky game.

Jobless Claims

Rising jobless claims could signal a weakening job market, affecting economic growth and consumer spending. Data supporting rising unemployment will also support a rate cut.

As the bond market predicts a higher likelihood of a rate cut this year, mortgage rates improve. Mortgage rates typically rise when bond prices fall because they are inversely related through their yields. When investors sell bonds, prices drop, causing yields (interest rates) to rise. Higher bond yields indicate higher borrowing costs, including for mortgages, as lenders adjust rates to stay competitive. Bond prices are influenced by factors like changes in Federal Reserve interest rates, inflation expectations, and overall economic conditions. Anticipation of higher future rates or inflation can lead to bond sales, driving prices down and yields up, thereby increasing mortgage rates.

This news is directly beneficial to homebuyers.

BIG INFLATION NEWS THIS WEEK

Headline Inflation:

Headline Replacement: 0.21%

June Expectation: 0.1%

If June's monthly CPI increase is 0.1%, the annual headline inflation should decrease from 3.3% to 3.1%, which would be positive for bonds.

Core Inflation:

The core inflation reading excludes food and energy prices.

Core Replacement: 0.195%

Core Expectation: 0.2% to 0.28%

Predictions for core inflation vary between 0.2% and 0.3% monthly increases. If core inflation rises by 0.2%, the annual rate might stay at 3.4%. However, if it reaches 0.3%, the annual rate could rise to 3.5%, which would likely negatively impact the market. An increase in the Core CPI’s annual rate would cause bond prices to fall and mortgage rates to worsen. If you’re under contract and closing in July, it’s advisable to lock in your rate now.

When Will Mortgage Rates Improve?

The market is now pricing in a 78% probability of a Fed rate cut in September, up from 64% a week ago and 50% a month ago. The increasing likelihood of a rate cut is due to several economic factors:

Rising Unemployment: Unemployment has risen to 4.1%, the highest since November 2021.

Slowing Jobs Growth: Job growth is at 1.7% year-over-year, the lowest since March 2021.

Slowing Wage Growth: Wage growth has slowed to 3.9% year-over-year, the lowest since May 2021.

Falling Inflation: The Core PCE (Personal Consumption Expenditures) has risen by 2.6% year-over-year, the lowest since March 2021.

These indicators suggest a weakening economy, prompting expectations that the Fed will cut rates to stimulate growth. This week’s CPI report could surprise us or confuse the markets, but we won't know until it's released. What we do know is that the impacts of a high-rate environment are starting to show up in the data.

WHAT IS THE SAHM RULE?

Here’s What You Need to Know:

The "Sahm Rule" is a recession indicator developed by Claudia Sahm, a macroeconomist who has worked at the Federal Reserve and the White House Council of Economic Advisers. This rule signals the early stages of a recession when the three-month moving average of the U.S. unemployment rate increases by half a percentage point or more compared to the lowest three-month moving average unemployment rate over the past 12 months.

Key Points of the Sahm Rule:

Indicator of Recession: The Sahm Rule is a reliable and straightforward way to identify when the U.S. economy is entering a recession.

Current Status: The Sahm Rule threshold is close to being triggered. The three-month moving average unemployment rate is currently 0.43 percentage points above its cycle low. If the unemployment rate rises slightly more, it will cross the key threshold.

Recent Unemployment Trends:

The U.S. jobless rate has increased from 3.4% in April 2023 to 4.1% in June 2024, indicating a weakening labor market.

If the three-month moving average continues to rise and surpasses the 0.50 percentage point increase, the Sahm Rule will confirm that the U.S. is in a recession.

Is a Recession Good for the Housing Market?

Potential Benefits:

Lower Interest Rates: During a recession, central banks often lower interest rates to stimulate the economy. Lower mortgage rates can make buying a home more affordable, potentially boosting home sales.

Increased Affordability: Home prices may decline due to reduced demand, making homes more affordable for financially stable buyers. With current low inventory levels and high demand, many approved buyers are on the sidelines. In a formal recession with mortgage rates lowered by 0.5-0.75%, demand could outpace supply.

Potential Drawbacks:

Falling Home Prices: Reduced demand can cause home prices to fall, negatively impacting current homeowners looking to sell or refinance.

Tighter Credit Conditions: Lenders may become more cautious during a recession, making it harder for buyers to qualify for mortgages, even with lower interest rates.

Increased Foreclosures: Job losses and economic hardship can lead to more foreclosures, flooding the market with distressed properties and further depressing home prices.

Take a close look at the charts below to understand these trends bette

WHY I AM STILL BETTING ON HOMEOWNERSHIP- ARE YOU?

You likely remember the impact of the 2008 housing crisis, even if you didn't own a home back then. Many people fear a similar event occurring again, but the current market is fundamentally different. Economists overwhelmingly do not anticipate a crash in 2024 or beyond due to the lack of an oversupply of houses for sale. Unlike the lead-up to 2008, today there's an undersupply, even with recent inventory growth.

Key Points on Housing Supply:

Existing Homes: The supply of existing homes remains low overall, despite an increase compared to last year.

New Home Construction: Builders are cautious and are underbuilding compared to pre-crisis levels, trying to catch up from past underproduction.

Distressed Properties: Stricter lending standards have led to fewer foreclosures, preventing a flood of distressed properties that could drive prices down.

Market Stability:

Inventory Levels: Current inventory levels are not high enough to trigger a significant price drop or market crash.

Expert Opinions: Experts like Mark Fleming and Lawrence Yun emphasize that the fundamental issue is a lack of supply relative to demand.

Safe Lending Practices: There are no risky subprime mortgages, and builders are not overproducing homes.

In summary, the housing market is not heading towards a crash similar to 2008. Real estate remains a sound investment for building lasting wealth. If you’re ready to start your journey toward homeownership, let’s connect today.

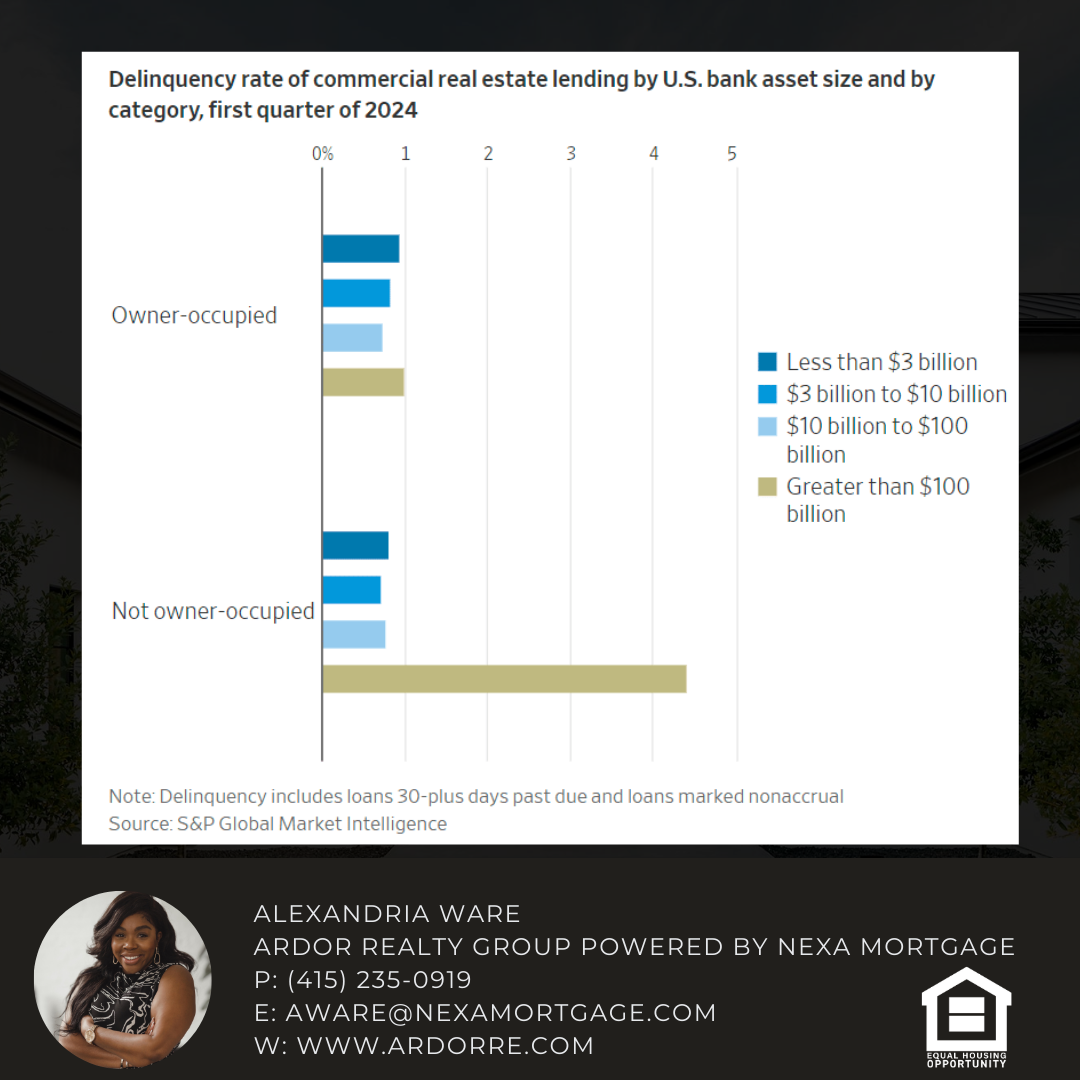

NEW DATA SHOWS BIG BANKS ARE MORE AT RISK FROM CRE LOANS THAN SMALLER LENDERS

Contrary to the belief that commercial real estate (CRE) troubles primarily affect smaller or regional banks, recent data indicates that big banks are currently facing the most strain.

Key Points:

Loan Exposure: While smaller banks hold a significant portion of CRE and multifamily property debt in the U.S., the top 25 largest banks are experiencing higher loan delinquencies. The performance of CRE loans varies based on factors such as loan purpose and property type.

Delinquency Disparities: Data from S&P Global Market Intelligence reveals that loans for properties intended to be leased (non-owner-occupied) and held by banks with over $100 billion in assets have higher delinquency rates. In the first quarter, over 4.4% of these loans were delinquent or in nonaccrual status, compared to less than 1% for smaller banks and owner-occupied loans.

Analysis:

Interest Rates Impact: Higher interest rates are a key factor. Owner-occupied CRE loans perform well if the business is healthy and can make payments, according to S&P Global. Leased properties, however, are more sensitive to interest rates. Problems arise if rental income doesn’t cover rising loan costs or refinancing.

Geography: Geography also plays a role. Though big banks aren't the only ones lending in downtown areas, larger banks face more immediate maturities. MSCI Real Assets shows national banks held 29% of maturing office debt last year and 20% this year, while regional banks held 16% and 13%. With balloon payments common, banks with closer payoffs must assess repayment risks.

The Takeaway:

Big banks are facing growing CRE challenges with a 1.1% net charge-off rate for non-owner-occupied CRE loans in Q1, a full point higher than smaller banks. If the property downturn worsens, smaller banks could be hit hard, and the exposure could shift. However, if high interest rates continue with a steady economy, these smaller banks might see hidden value emerge.

My Thoughts on Commercial Real Estate Investment

Now is an opportune time to purchase commercial real estate at significantly discounted prices in select areas even in the high interest rate environment. The market dynamics are presenting unique opportunities for savvy investors. Here’s why:

Discounted Prices: Current market conditions have driven down prices in many commercial real estate sectors. Economic uncertainties and higher interest rates have put pressure on property values, creating buying opportunities at lower prices than we’ve seen in years.

Creative Financing: In today’s market, there are more options for creative financing. Traditional lenders might be tightening their requirements, but alternative financing methods are gaining traction. Investors can leverage opportunities such as private lending, bridge loans, and mezzanine financing to structure deals that were not as accessible before.

Seller Financing: More sellers are now willing to contribute with seller financing. This can reduce the upfront capital required and provide more favorable terms for buyers. Seller financing can also speed up transactions and offer more flexible payment schedules.

Inflation Hedge: Commercial real estate can be a powerful hedge against inflation. As inflation rises, the value of tangible assets like real estate typically increases. Additionally, many commercial leases include rent escalation clauses tied to inflation, ensuring that rental income keeps pace with rising costs.

Income Generation: Despite economic fluctuations, commercial properties can provide steady rental income. Well-located and well-managed properties continue to attract tenants, providing a reliable cash flow that can offset inflationary pressures.

Appreciation Potential: While the immediate market may be volatile, commercial real estate has strong long-term appreciation potential. Buying at a discount now could yield substantial returns as the market stabilizes and property values recover.

Diversification: Investing in commercial real estate adds diversification to an investment portfolio. It offers a different risk profile compared to stocks and bonds, which can be particularly advantageous during times of economic uncertainty.

Conclusion

Investing in commercial real estate now, with the benefit of lower prices, creative financing options, and inflation protection, can be a strategic move. For those ready to navigate the current market and capitalize on these opportunities, commercial real estate can provide lucrative returns and long-term financial security. If you’re considering this path, let’s connect and explore the possibilities together.