Volatility Continues, Have Rates Peaked?

RATES, DEMAND, SUPPLY, & THE FEDS

As news of increasing rates dominates headlines, the demand for mortgages declines. Recent data shows a 4% decrease in mortgage applications for home purchases compared to last week, and a significant 30% decrease compared to the previous year. Refinance applications have also dropped by 5% in the past week and a staggering 44% compared to the previous year, coinciding with the average 30-year mortgage rate inching up to 6.69%.

Three years ago, the 30-year mortgage rate stood at 3.15%, and the average price of a new home in the US was $369,000. Today, the 30-year mortgage rate has doubled to 6.69%, while the average new home price has surged to $501,000. This significant rate difference, coupled with an increased average down payment of $26,000, has led to mortgage payments being 100% higher for buyers. Affordability is now the top concern for potential homebuyers, especially with the looming possibility of a recession and the fear of job loss.

Recent layoffs, such as those at Meta, have affected various industries, including ad sales, marketing, and partnerships. While companies like Google, Microsoft, Meta, and Amazon are hiring, they are doing so at lower salary levels. Furthermore, banks are also reducing their workforce in large numbers.

Surprisingly, 63% of laid-off tech workers have started their own companies, with 93% of them competing against their former employers. However, the question of affordability remains: Should home prices decrease or rates become more favorable? Will wages grow? And how will job market uncertainty impact demand?

Despite a 23% decrease in home sales compared to the previous year, home prices have only dropped by 4% from their peak levels. Despite the rapid rate hikes, the housing market has remained relatively stable. With many homeowners locked into low mortgage rates and little incentive to sell, a significant increase in housing inventory is unlikely.

The likelihood of another rate hike by the Federal Reserve before July stands at 66%. However, there is some optimism as the rates may soon reach their peak and potentially reverse. It's worth noting that the strain rate hikes put on the economy is evident in the regional banking crisis. The reduced willingness of banks to lend could adversely affect demand, but it's important to remember that alternative mortgage options outside the traditional banking system still exist, offering comparable or even better rates and terms.

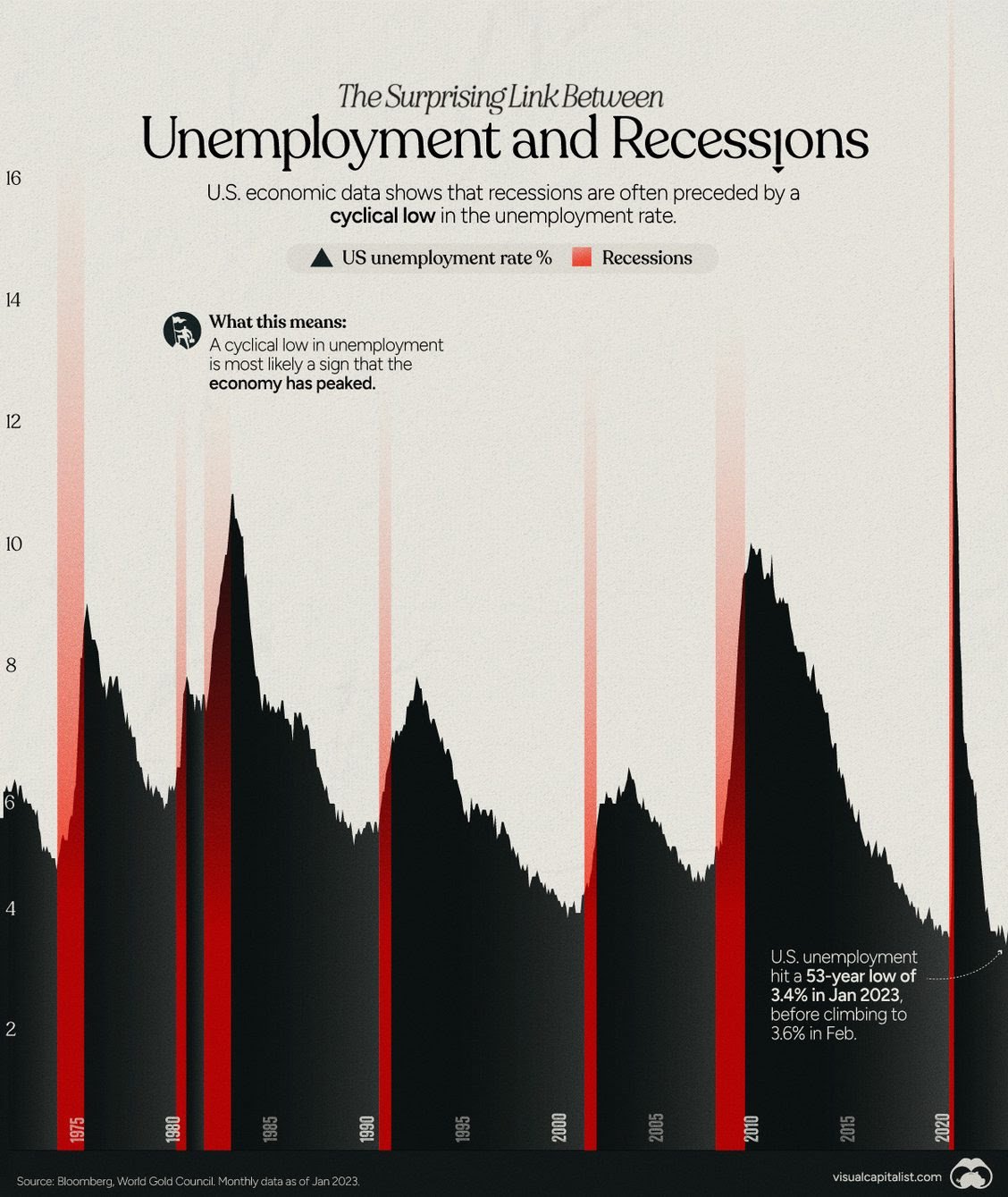

The job market also plays a crucial role in influencing demand. Uncertainty about job security discourages individuals from pursuing homeownership. During recessions, layoffs increase, and continued rate hikes may exacerbate this scenario.

WHAT HAPPENS NEXT?

The upcoming CPI report is scheduled for release on June 13 at 8:30 AM EST. It is anticipated that the reported number will be lower than expected. We are optimistic that this news might influence the Federal Reserve's decision regarding rate hikes, especially considering their meeting taking place from June 13 to 14.

In addition, Germany, the fourth-largest economy globally, recently announced on May 25, 2023, that it has entered a recession.

"Under the weight of immense inflation, the German consumer has fallen to his knees, dragging the entire economy down with him," said Andreas Scheuerle, an analyst at DekaBank.

Household consumption was down 1.2% quarter on quarter after price, seasonal and calendar adjustments. Government spending also decreased significantly, by 4.9%, on the quarter.

— Reuters

NEED DEBT CONSOLIDATION OPTIONS?

Rising home values may give you a source of money you haven’t considered. A home equity line of credit (HELOC) can unlock those funds. Most HELOCs take weeks from the time you apply to the time you get your money. Not NEXA Equity Express.

5 minutes to close. 5 days to fund. That’s all it takes to tap your home equity with a fixed-rate NEXA Equity Express. Use the money to improve your home, pay off higher-interest debt, finance education, or pay for other major expenses. It’s your choice.